In the dynamic world of financial services, institutions are constantly seeking innovative solutions to stay ahead. One such game-changer is the Financial Services Cloud (FSC), a product by Salesforce.com, designed to revolutionize customer relationship management in the financial sector. In this blog we will see Overview of Financial Services Cloud (FSC)

Introduction of Financial Services Cloud (FSC)

Salesforce Financial Services Cloud (FSC) is a robust customer relationship management (CRM) system designed specifically for financial services companies. It helps organizations manage customer relationships more skillfully, expand more quickly, and gain a deep understanding of their clients.

FSC is an industry-specific offering from Salesforce with out-of-the-box workflows and a data model specific to the Financial Services Industry. It caters to three important Financial Services verticals: Wealth and Asset management, Banking, and Insurance.

The platform excels in managing client information, accounts, and records, providing a 360-degree view of individual and household financial data. It includes features like multitenant architecture, data services, API services, and customer data.

FSC comes with pre-assembled flows for the Financial Services Industry. Customers can make appropriate changes to these flows to tailor them to their specific needs and quickly go live instead of spending months developing custom processes.

History of Financial Services Cloud (FSC)

When FSC was first released on 2016, it was initially designed to support wealth management. Over time, it has been enhanced to support other aspects of financial services, including retail banking, commercial banking, and insurance carrier markets.

Features of Financial Services Cloud (FSC)

FSC is the world’s #1 CRM, reimagined for financial services. It allows institutions to connect across lines of business, geographies, and channels. Here are some key features:

- Industry-Specific Features: FSC includes features developed with commercial and retail banks, wealth management firms, asset managers, and insurers in mind.

- Commercial and Retail Banks: FSC provides a unified view of every customer interaction across multiple channels, enabling banks to deliver personalized experiences and services. It includes pre-defined record types for various financial statements, such as investment accounts, bank deposits, and loan accounts.

- Wealth Management Firms: FSC empowers wealth management firms to implement the right digital strategies for their businesses. It enables the delivery of personalized financial solutions at scale to all customer segments while also elevating the client experience. It also allows firms to set Financial Goals for their clients based on the individual or family, allowing them to create and document a strategy to help them achieve their financial objectives.

- Asset Managers: FSC provides asset managers with a comprehensive view of their clients’ financial portfolios, enabling them to make informed decisions and provide personalized advice. It also offers advanced need-based lead and referral scoring, which helps differentiate between leads and ideal clients.

- Insurers: FSC enables insurers to streamline their operations and improve customer engagement. It provides a 360-degree view of policyholders, enabling insurers to deliver personalized experiences and services.

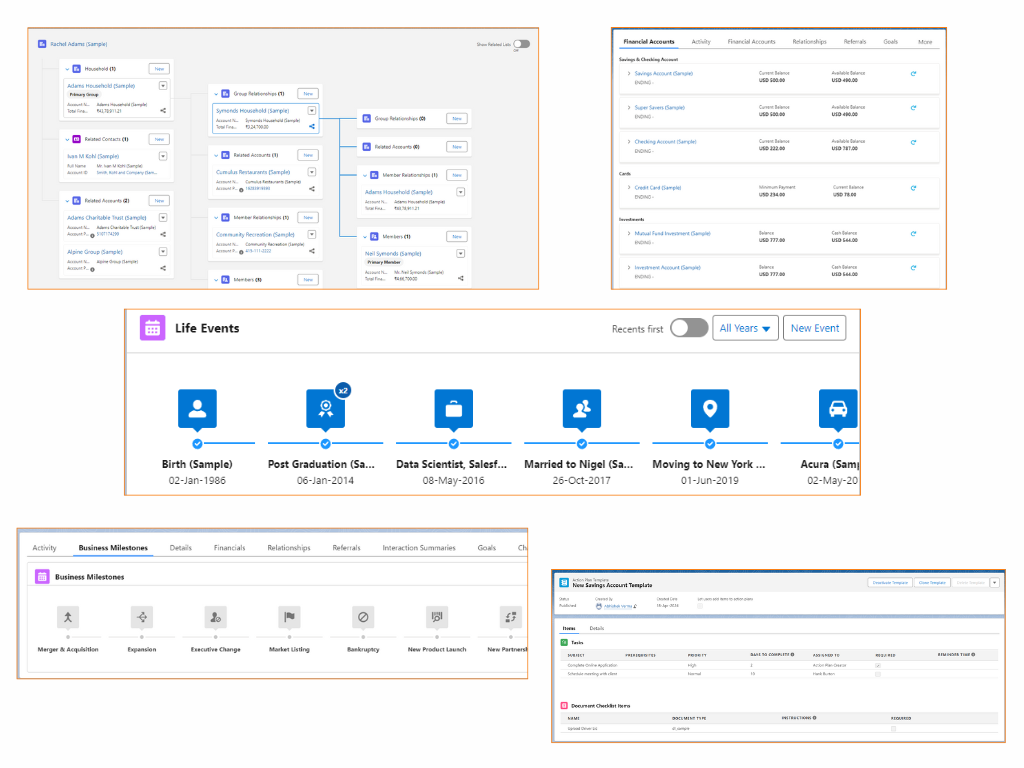

- Financial Account Tracking: FSC includes a native Financial Account object with pre-defined record types for different types of financial accounts such as investment accounts, insurance policies, bank deposits, and loan accounts.

- Investment Accounts: These can include various types of investments such as stocks, bonds, mutual funds, etc. FSC allows you to view holdings within an investment account, providing a detailed view of the client’s investment portfolio.

- Insurance Policies: FSC supports tracking of various types of insurance policies. This can provide a comprehensive view of the client’s insurance coverage and premiums.

- Bank Deposits: This includes checking and savings accounts. FSC provides a unified view of all bank deposits, enabling financial advisors to have a complete understanding of the client’s liquidity and cash flow.

- Loan Accounts: This can include home loans, auto loans, personal loans, etc. FSC allows for tracking of all loan accounts, providing insights into the client’s liabilities.

- In addition to these, FSC also supports other types of financial accounts such as credit card accounts, 401(k) accounts, and more. All these accounts can be associated with roles such as primary owner, beneficiary, or trustee.

- Goal Setting: The Goal Setting feature in FSC allows financial advisors to set Financial Goals for their clients. These goals can be set based on the individual or household, allowing advisors to build and document a strategy to help clients achieve their financial goals.

- Creating a Financial Goal: Financial advisors can create a financial goal to track a client’s progress toward major purchases, retirement savings, or other life goals. This is done on the Goals tab of the client or household profile. The advisor enters a name for the goal, selects the household member who is the goal’s primary owner, enters the relevant information, and saves the record.

- Types of Goals: Currently, FSC only supports the creation of savings-oriented goals. This means goals can be created for things like saving for a house, planning for retirement, or setting aside money for a child’s education. It does not support the creation of goals for paying down a debt.

- Associating Goals: While you can associate a goal with a specific individual or household, you cannot associate a goal with a specific financial account.

- Tracking Progress: Once a goal is set, it can be tracked in the Goals tab or the Related tab. This allows advisors and clients to monitor progress and make adjustments as necessary.

- Lead and Referral Tracking: FSC provides native support for tracking referrals through the complete lifecycle, including tracking acceptance and conversion.

- Creating a Referral: Referrals can be created by anyone in your organization, partners, and even customers. Wherever the customer has contact with your business, someone can create a referral to help them. The referral captures the customer’s expressed need so that it doesn’t get lost.

- Tracking Referrals: Once a referral is created, it can be tracked carefully from creation to close. This ensures that someone is always following up on them. The home page for Financial Services Cloud is where your advisors and retail bankers go to plan their day and track referral information.

- Prioritizing Referrals: To help advisors and retail bankers prioritize their referrals, FSC uses Einstein Lead Scoring. This identifies how likely a referral is to convert. Once a referral is scored, advisors and bankers can decide which customers to engage with first.

- Referral Lifecycle: The lifecycle of a referral can be tracked using Salesforce standard Lead management functionality. This includes stages like referral creation, assignment, acceptance, prioritization, and conversion.

- Top Referrers: Your top referrers are a key part of your business. A referrer is someone who creates a referral, and your top referrers are the ones who create the referrals that are most likely to convert. The home page lists your Top Referrers, and you can view details about their referrals.

- Action Plans: Action Plans in FSC are designed to capture repeatable tasks and automate the sequence of these tasks, thereby improving collaboration and productivity. FSC includes Action Plans that enable your employees to deliver consistent and compliant client engagement experiences through automation and tracking.

- Creating an Action Plan: Action plans are created from action plan templates, which allow you to capture repeatable tasks. Each task within an action plan has a priority, a number of days in which it must be completed, and a person who is responsible for it. Users can see the tasks assigned to them through task lists and views.

- Types of Action Plans: Action plans can be used for various client engagements. For example, you can create an action plan template for financial plan review meetings with clients. For such engagements, wealth managers need to set up a meeting in advance, collect financial documentation, and review the documentation. You set up this action plan template once, and update it as your understanding of the repeatable tasks refines over time.

- Tracking Action Plans: Users can record task status information using the standard interfaces for tasks or the Action Plan details view. Target records, such as accounts or contacts, also show lists of related action plans.

- Automation and Consistency: By automating task sequences, action plans ensure that your employees deliver consistent and compliant client engagement experiences. This is particularly useful in regulated industries where compliance is crucial.

- Integration with Standard Features: Your users interact with action plans using standard Salesforce features. This means that action plans can be seamlessly integrated into your existing Salesforce workflows.

- 360-Degree Client View: The 360-Degree Client View is a key feature of FSC that provides a comprehensive view into clients’ financial profiles. This feature puts your customer at the center of every interaction, enabling you to deliver personalized and effective services

- Comprehensive Customer View: The 360-Degree Client View provides a complete view of a customer’s relationship with your company. It includes a history of every interaction they’ve had with your company, including everything they told you during the sales cycle, every time they’ve called in for service, what marketing campaigns they’ve seen or ebooks they’ve downloaded, and even what events they’ve attended.

- Customer Details: The 360-Degree Client View also includes information about who the customers are, details about their business, what businesses they’re related to, who has the buying power, and things like what technologies they use or the subindustry they’re a part of. It’s your customer’s story, from beginning to end.

- Benefits to the Business: Having accurate customer information has a multitude of benefits. It lets sales managers and executives get a view of all the deals in aggregate, meaning accurate forecasts and a chance to see which deals might slip. Business decisions—from staffing to territories—are informed by data. Good, clean data leads to good decisions.

- Benefits to Sales Reps: It helps them keep track of everything about their customers, so the burden is off of them to remember every single conversation and all those facts about their customers’ kids. It builds that gorgeous 360-degree view that helps them personalize their interactions with each customer to help find the perfect solution. All that customer data and information about the deal is stored in one place, so if your reps need to bring in a selling team, everyone can quickly get up to speed. It saves them loads of time!

- Actionable Relationship Center (ARC) : ARC feature in FSC provides a comprehensive view of a client’s family wealth ecosystem. This feature helps advisors grow their book of business across multiple networks.

- Visualizing Wealth Ecosystem: With the Relationship Map, advisors can visualize a client’s family wealth ecosystem and financial accounts in a single snapshot. This allows them to drill into opportunities to deepen and grow their book of business.

- Uncovering Opportunities: For instance, an advisor can discover that a client has become the beneficiary of a trust that is in need of estate-planning services. This insight can lead to new business opportunities.

- Holistic View of Assets: The feature also provides a holistic view of both managed and held-away assets. This helps advisors keep track of their clients’ top relationships and uncover new opportunities.

- Growing Business Across Networks: By having insight into a client’s family wealth ecosystem, advisors can grow their book of business across multiple networks. This richer context helps personal bankers understand who their customers are, what financial products they have, and what they can use to achieve their life goals.

- Contextual Understanding: FSC provides a richer context that helps personal bankers understand who their customers are, what financial products they have, and what they can use to achieve their life goals.

- Understanding Customers: This feature provides a comprehensive view of a customer’s financial profile, including their financial goals, accounts, transactions, and relationships. This helps personal bankers understand their customers’ financial situations, preferences, and needs.

- Financial Products: By having a complete view of the financial products that a customer has, personal bankers can provide more personalized advice and recommendations. They can identify gaps in the customer’s financial plan and suggest suitable products to fill those gaps.

- Achieving Life Goals: The feature also helps personal bankers understand what their customers’ life goals are. Whether it’s buying a house, saving for retirement, or funding a child’s education, personal bankers can use this understanding to help customers develop a strategy to achieve their goals.

- Personalized Interactions: With a richer context, personal bankers can personalize their interactions with each customer. They can tailor their communication and service based on the customer’s unique needs and preferences.

- Improved Decision Making: The feature also supports decision making by providing insights and analytics based on the customer’s financial data. This can help personal bankers make informed decisions and provide better financial advice.

- Productivity Tools: New productivity tools in FSC help advisors and personal bankers work faster and smarter than ever.

- Automating Routine Processes: FSC includes powerful productivity tools and integrated partner apps that allow you to automate routine processes with customizable actions. This can include tasks such as scheduling meetings, sending follow-up emails, and updating client records.

- Client Referral Tracking: One of the key productivity tools in FSC is client referral tracking. This tool ensures that you never miss an opportunity by keeping track of all client referrals and their status. It helps advisors and personal bankers manage their pipeline effectively.

- Collaboration Tools: FSC also includes collaboration tools that enable advisors and personal bankers to work together more effectively. These tools can facilitate communication, document sharing, and task management among team members.

- Data Management: FSC provides tools for managing large amounts of client data in an efficient and organized manner. This can help advisors and personal bankers make informed decisions and provide better financial advice.

- Integration with Standard Features: The productivity tools in FSC can be seamlessly integrated into your existing Salesforce workflows. This means that advisors and personal bankers can leverage these tools without having to learn new systems or processes.

Sample Use Cases of Financial Services Cloud (FSC)

FSC shines in various use cases across the financial sector:

1. Automated Client Onboarding

Use Case: Streamlining the process of bringing new clients into the wealth management service. Example: A new client, Sarah, signs up for wealth management services. FSC automates the collection of her financial data, sets up her profiles, and initiates a financial health check, all while ensuring compliance with regulatory standards.

2. Comprehensive Client Profiles

Use Case: Creating a 360-degree view of the client’s financial situation. Example: For an existing client, John, FSC aggregates all his financial accounts, assets, and liabilities into one dashboard, giving his wealth manager, Mike, a complete overview for better-informed advice.

3. Proactive Relationship Management

Use Case: Anticipating client needs and life events to provide timely financial advice. Example: FSC alerts the wealth manager when a client, like Emma who just had a baby, experiences a life event that could impact her financial goals, prompting a review of her investment strategy.

4. Portfolio Management and Optimization

Use Case: Utilizing AI to analyze and optimize client portfolios. Example: FSC uses AI to suggest adjustments to a client’s portfolio, like recommending more environmentally sustainable investments for eco-conscious investor, Alex.

5. Collaborative Financial Planning

Use Case: Engaging clients in the financial planning process with interactive tools. Example: FSC provides collaborative tools that allow clients, such as retiree Bob, to work with his wealth manager in real-time to adjust his retirement plan based on changing market conditions.

6. Wealth Management as a Service

Use Case: Offering wealth management services through various distribution channels. Example: FSC enables a fintech app to offer wealth management services, allowing users to access financial advice and portfolio management directly within the app.

7. AI-Driven Lead Generation

Use Case: Leveraging AI to identify and attract potential clients. Example: FSC’s AI capabilities analyze market data to identify potential clients, like young professionals with growing income, for targeted marketing campaigns.

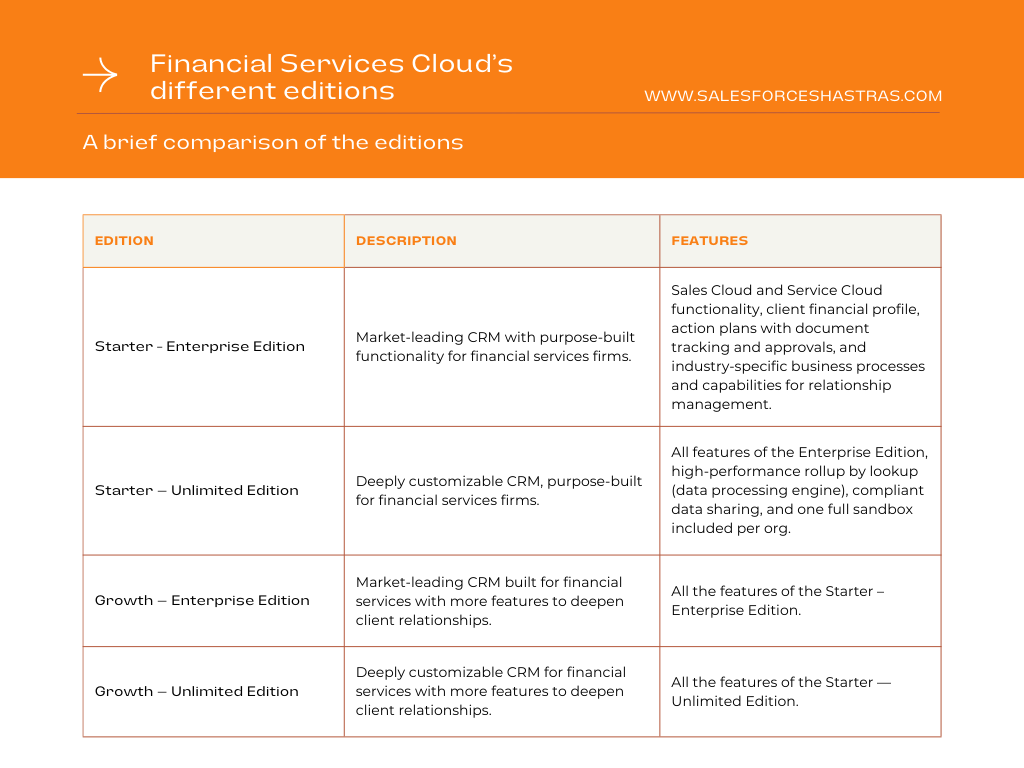

Financial Services Cloud’s different editions

For the most accurate and up-to-date information, please visit the official Salesforce website or contact their sales team: Financial Services Cloud Pricing

Checkout our other blogs

Conclusion

The Financial Services Cloud (FSC) is a powerful tool that brings continuous innovation to financial services organizations. It not only improves the customer experience but also enhances the productivity of advisors and personal bankers. With FSC, financial institutions can unlock the full power of their services and stay ahead in the competitive financial market.