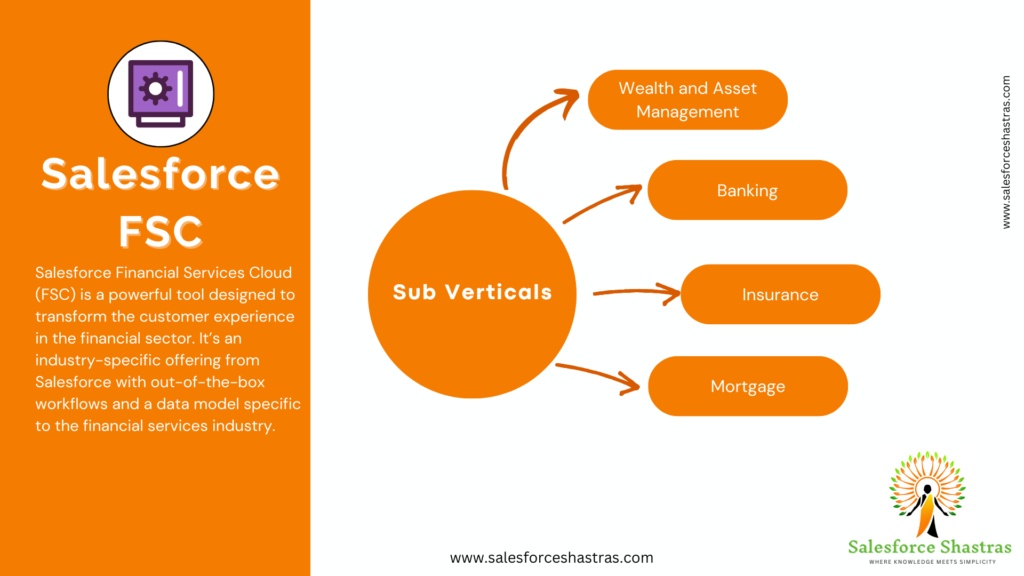

Salesforce Financial Services Cloud (FSC) is a powerful tool designed to transform the customer experience in the financial sector. It’s an industry-specific offering from Salesforce with out-of-the-box workflows and a data model specific to the financial services industry. Let’s delve into the Sub Verticals of Financial Services Cloud (FSC).

1. Wealth and Asset Management

This Sub Verticals of Financial Services Cloud (FSC) caters to private banks and registered investment advisors. It provides a unified view of all client data, enabling advisors to deliver personalized advice and nurture client relationships. With FSC, wealth and asset management firms can streamline their operations and provide a superior client experience.

Real-world examples:

- Unified View of Client Data: Imagine a wealth management advisor named John. He has multiple clients, each with various accounts, investments, and financial goals. Before FSC, John had to juggle multiple systems to get a complete picture of each client’s financial situation. With FSC, all of this information is consolidated into a single platform. Now, John can see all relevant client data in one place, making it easier for him to manage and advise his clients.

- Personalized Advice: Let’s consider one of John’s clients, Sarah. She recently had a life event – she got a promotion. John, having a complete view of Sarah’s financial situation and knowing about her promotion, can provide personalized advice. He suggests Sarah increase her retirement contributions and invest in a higher-risk portfolio that aligns with her increased income and long-term financial goals.

- Nurturing Client Relationships: FSC also helps John nurture his relationships with his clients. For example, John uses FSC to set reminders for regular check-ins with his clients. During these check-ins, John discusses their financial goals, provides updates on their portfolio, and addresses any concerns they might have. This regular communication helps John build strong, lasting relationships with his clients.

- Streamlining Operations: Before FSC, John spent a significant amount of time on administrative tasks, such as updating client information across multiple systems and generating reports. With FSC, many of these tasks are automated. For example, when Sarah’s address changes, John updates it in FSC, and the change is automatically reflected across all associated records. This automation allows John to spend more time advising his clients and less time on administrative tasks.

- Superior Client Experience: All of these features contribute to a superior client experience. Sarah appreciates the personalized advice and regular communication from John. She also enjoys the convenience of the client portal, where she can view her portfolio, communicate with John, and access financial planning tools. As a result, Sarah is more likely to continue using John’s services and recommend him to others.

2. Banking

The banking Sub Verticals of Financial Services Cloud (FSC) serves both B2B and B2C sectors. It empowers banks to unify customer experiences across all departments and channels. With FSC, banks can gain a 360-degree view of their customers, enabling them to provide personalized services and improve customer satisfaction.

Commercial Banking:

FSC for Commercial Banking provides relationship managers and product specialists with a complete view of every customer’s business and commercial accounts. For example, a relationship manager at a bank could use FSC to easily view all the accounts, loans, and services used by a business client. This can help the manager identify opportunities to grow the relationship, such as offering a new line of credit to the business. The platform also streamlines the onboarding of new clients by automating routine processes and tracking referrals. For instance, when a new business client is onboarded, FSC could automatically create a new account for them, assign a relationship manager, and schedule a welcome call.

Let’s take the example of a relationship manager named John at “Global Bank”. He manages business and commercial accounts. With FSC, John can easily view all the accounts, loans, and services used by a business client, say “Tech Corp”. This can help John identify opportunities to grow the relationship, such as offering a new line of credit to “Tech Corp”. When a new business client is onboarded, FSC could automatically create a new account for them, assign a relationship manager, and schedule a welcome call.

Retail Banking:

FSC for Retail Banking provides bankers, loan officers, tellers, and operations associates with a 360-degree view of their customers. This can help retail banks deliver personalized service anytime, anywhere. For example, a teller at a bank could use FSC to view a customer’s account history and preferences, allowing them to provide personalized service during each interaction. The platform also allows for the automation of routine processes and tracking of referrals. For instance, if a customer is interested in opening a new savings account, FSC could automatically generate the necessary paperwork and track the referral from the teller.

In the case of retail banking, consider a teller named Mary at “Global Bank”. With FSC, Mary can view a customer’s account history and preferences, allowing her to provide personalized service during each interaction. For instance, if a customer, say Mrs. Johnson, is interested in opening a new savings account, FSC could automatically generate the necessary paperwork and track the referral from Mary.

3. Insurance

The insurance Sub Verticals of Financial Services Cloud (FSC) caters to life and annuities, and property & casualty insurance sectors. It enables insurance agents to deliver personalized experiences to policyholders. With FSC, insurance companies can streamline their processes, manage policies efficiently, and improve policyholder satisfaction.

- Life and Annuities: Consider an insurance agent named Alice who works for an insurance company “InsureLife”. Alice has multiple clients with various life and annuity policies. With FSC, Alice can have a unified view of all her client data in one place. For instance, if one of her clients, say Mr. Johnson, recently had a life event like the birth of a child, Alice can offer him a new life insurance policy or suggest modifications to his existing annuity policy to better secure his child’s future.

- Property & Casualty: Now, consider another insurance agent named Bob who works for “SafeHome”, a company that provides property and casualty insurance. Bob can use FSC to manage his clients’ policies efficiently. For example, if a client, say Mrs. Smith, files a claim for property damage due to a natural disaster, Bob can use FSC to quickly access Mrs. Smith’s policy details, assess the coverage, and expedite the claim process. This leads to improved policyholder satisfaction as claims are handled promptly and efficiently.

- Personalized Experiences: FSC enables insurance agents like Alice and Bob to deliver personalized experiences to their policyholders. For instance, if Alice notices from her FSC dashboard that Mr. Johnson’s annuity policy is about to mature, she can proactively reach out to him with personalized advice on the best ways to reinvest or utilize the maturity amount.

- Streamlined Processes: FSC helps insurance companies streamline their processes. For example, when a new policyholder is onboarded, FSC can automate many routine tasks such as creating a new policy record, scheduling a health check-up (in case of life insurance), or property inspection (in case of property insurance), thus saving valuable time for the agents and providing a smooth onboarding experience for the policyholders.

4. Mortgage

FSC for Mortgage simplifies and accelerates the mortgage application process. It provides a unified mortgage experience for borrowers, lenders, and partners, including guided loan applications, streamlined document tracking, and approvals. The platform also includes a new mortgage data model for lenders to build deeper, more complete relationships with each borrower.

- Simplified and Accelerated Mortgage Application Process: Consider a mortgage loan officer named Sofia at a bank called “Cumulus Mortgages”. Sofia assists prospective borrowers in choosing and applying for suitable loan products. With FSC, Sofia can guide clients like Richard through the mortgage application process, making it look effortless to borrowers. This is because FSC includes guided loan applications that simplify and accelerate the mortgage process, reducing the loan origination processing time significantly.

- Unified Mortgage Experience: FSC provides a unified mortgage experience for borrowers, lenders, and partners. For instance, mortgage underwriters like Shah at “Cumulus Mortgages” can determine if a borrower qualifies for a mortgage using the three C’s of mortgage underwriting: Credit reputation, Capacity, and Collateral. With FSC, Shah can make a determination to approve, suspend, or decline Richard’s application file more efficiently.

- Streamlined Document Tracking and Approvals: FSC also provides simplified document collection with templatized checklists and automated approval management. This means that Sofia can track the necessary documents and manage approvals more efficiently, making the mortgage lending process smoother for all parties involved.

- Building Deeper Relationships with Borrowers: Lastly, FSC includes a new mortgage data model that allows lenders to build deeper, more complete relationships with each borrower. For example, Sofia can view details in context with a borrower’s household relationships, goals, and other financial accounts. This enables her to provide personalized advice and services to each borrower, thereby improving the overall customer experience.

Conclusion

Salesforce Financial Services Cloud (FSC) is a powerful tool that enables financial institutions to deliver personalized services, improve customer satisfaction, and streamline their operations across various sub-verticals. Whether it’s commercial banking, insurance, mortgage, retail banking, or wealth management, FSC has got it all covered!

I love the way you explain things. It makes it so easy to understand.