Salesforce Financial Services Cloud (FSC) is a powerful platform designed to transform the customer experience in the financial services industry. It offers a range of features that enable financial institutions to build stronger relationships with their customers. In this blog we will explore all Features of Salesforce Financial Services Cloud (FSC)

Let’s delve into some of these key features of Salesforce Financial Services Cloud (FSC)

Actionable Segmentation

Actionable Segmentation is a feature in Salesforce’s Financial Service Cloud that enables organizations to group their clients based on similar characteristics or behaviors. This segmentation can be based on a variety of factors such as financial goals, investment preferences, risk tolerance, and more.

Actionable Segmentation enables you to segment similar client profiles, curate them, and design timely and personalized client outreach programs. The key elements of the Actionable Segmentation feature are actionable list definitions and actionable lists. These elements allow you to define the criteria for segmentation and create lists of clients who meet these criteria.

Action Launcher Component

The Action Launcher Component is a powerful feature in Salesforce’s Financial Services Cloud that enhances the efficiency and productivity of service agents. This component allows service agents to search for and launch a variety of actions directly from their interface, eliminating the need to navigate through multiple screens or menus.

These actions can include a wide range of tasks such as quick actions, OmniScripts, Screen flows, Field Service Mobile flows, and Autolaunched flows. Quick actions allow agents to perform common tasks with a single click, while OmniScripts guide agents through complex processes. Screen flows provide a visual guide for multi-step processes, and Field Service Mobile flows enable agents to manage field service tasks. Autolaunched flows automate processes that don’t require user interaction.

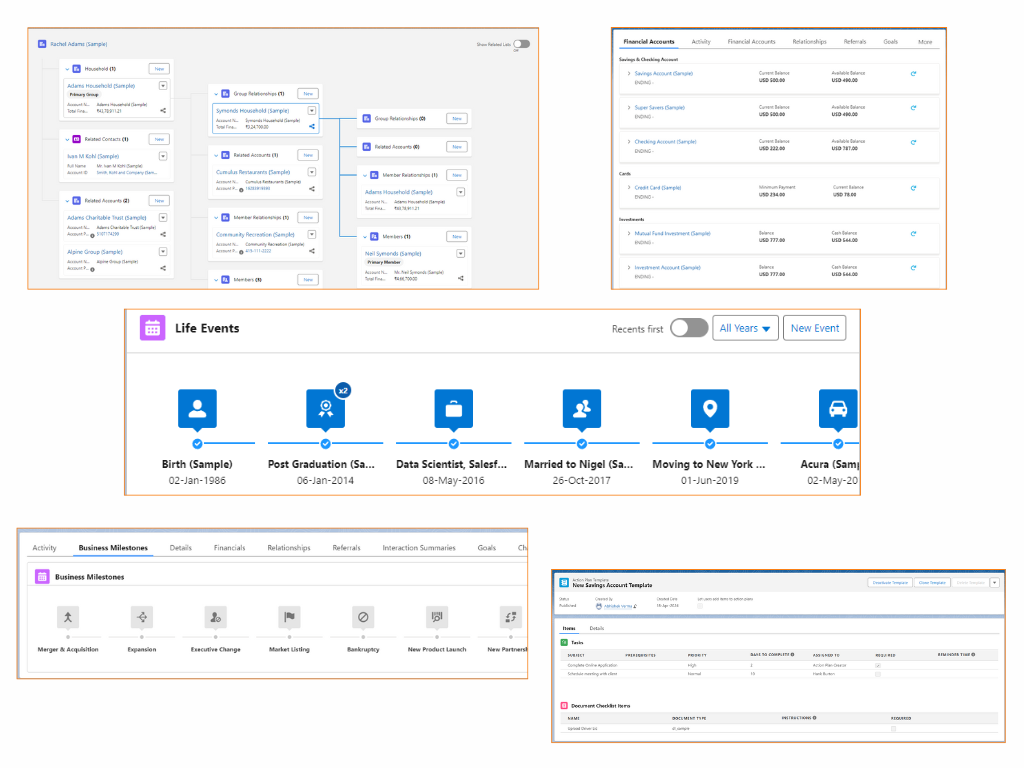

Action Plans

Action Plans are a powerful feature in Salesforce’s Financial Services Cloud that helps businesses streamline their operations and enhance productivity. This feature allows businesses to capture repeatable tasks in templates and then automate the task sequences.

For instance, if there are certain tasks that are performed regularly, such as account openings, loan approvals, or claims processing, these can be captured in an Action Plan. Once captured, these tasks can be automated, reducing the manual effort required and minimizing the risk of errors.

One of the key benefits of Action Plans is the ability to automatically assign task owners and deadlines for specific client engagements. This ensures that every task has a responsible person and a clear deadline, enhancing accountability and ensuring timely completion of tasks.

Actionable Relationship Center (ARC)

The Actionable Relationship Center (ARC) is a powerful feature that provides a comprehensive view of your customers’ relationships in an easy-to-navigate graph. This feature is designed to help you understand the intricate connections within your customer base, which can be crucial for delivering personalized and effective services.

ARC presents relationships among people and businesses in interactive components. This means you can visualize the connections between different entities, such as individuals, families, and businesses. This visualization can reveal important insights, such as shared interests, common contacts, and potential opportunities for engagement.

Furthermore, as the name suggests, the Actionable Relationship Center is not just about viewing relationships – it’s about taking action. The insights gained from ARC can be used to inform decision-making, guide customer interactions, and develop targeted marketing strategies.

Audit Trail in FSC

Audit Trail is a crucial feature in Salesforce’s Financial Services Cloud that enhances transparency and accountability. It allows service agents to inspect customer identity verification logs, providing a detailed record of all identity verification activities.

These logs are created when Customer Service Representatives (CSRs) use the Verify Customer Identity flow to confirm the customer’s identity. This could be during account creation, transaction authorization, or any other process where identity verification is required.

The Audit Trail feature provides a chronological record of these verification activities, including who performed the verification, when it was performed, and what information was used. This can be invaluable for auditing purposes, dispute resolution, and maintaining compliance with regulatory requirements.

Branch Management

Branch Management is a powerful feature in Salesforce’s Financial Services Cloud that enables organizations to effectively track and manage the performance and productivity of their branches. This feature is designed to provide a comprehensive view of various metrics related to branch performance.

These metrics can include a wide range of data points such as sales figures, customer satisfaction scores, and employee productivity levels. By having access to this information, organizations can gain valuable insights into the performance of each branch, identify areas for improvement, and make informed decisions to enhance productivity and customer satisfaction.

For instance, sales figures can provide a clear picture of a branch’s revenue generation capability, while customer satisfaction scores can shed light on the quality of service being provided. Similarly, employee productivity levels can help identify if there are any bottlenecks or inefficiencies that need to be addressed.

Business Rules Engine

The Business Rules Engine is indeed a powerful feature in Salesforce’s Financial Services Cloud (FSC). It is designed to automate complex decision-making processes, thereby enabling businesses to find solutions more quickly and efficiently.

The key components of the Business Rules Engine are expression sets and lookup tables. Lookup tables are constituted by decision matrices and decision tables. These components can be used to design business rules that provide automated business solutions in a workflow created using any tool.

The Business Rules Engine is a suite of services, components, and objects that can be used to create business rules that perform complex lookups and calculations. These components are available as part of Flows and OmniStudio. Additionally, you can use Connect APIs to integrate the Business Rules Engine with any workflow created using custom or third-party tools.

The workflow that you use to gather inputs passes the inputs to the Business Rules Engine, which then returns the outcome to the workflow that called the Business Rules Engine component. This allows for a seamless integration and interaction with workflows that are created using various tools and processes.

Caller Identity Verification

Caller Identity Verification is indeed a crucial feature in Salesforce’s Financial Services Cloud (FSC). It is designed to ensure the security of sensitive information by verifying the identity of a caller before any such information is shared.

This feature is particularly important for organizations that need to comply with regulations mandating customer identity verification. These regulations are in place to protect against potential losses and fraud. Failure to comply with these regulations can have legal consequences, making this feature all the more essential.

The process of identity verification can vary depending on the business. For instance, a customer service representative or contact center agent might ask the caller to confirm details such as their social security number, birth date, insurance details, or driver’s license number. This process helps ensure that the person contacting the call center is a genuine customer, a parent or guardian of a minor customer, or an authorized representative of a customer.

The Identity Verification feature can be customized to meet specific business and legal requirements. It relies on identity verification objects and identity verification flows. It also requires one of the three objects—Engagement Interaction, Messaging Session, or Voice Call—along with the Engagement Attendee and Engagement Topic objects.

Complaint Management

Complaint Management in Salesforce’s Financial Services Cloud (FSC) indeed offers a streamlined process for service agents to capture and submit client complaints directly from a Person Account record. This feature is designed to ensure that all issues are addressed promptly and effectively.

The Complaint Management feature provides a comprehensive solution for managing customer complaints. It allows service agents to capture and submit client complaints directly from a Person Account record. This means that service agents can quickly and easily record complaints, ensuring that they are properly documented and can be tracked effectively.

Once a complaint has been submitted, case agents can track and monitor the complaint. This includes tracking the status of the complaint, monitoring the progress of the investigation, and ensuring that the complaint is resolved in a timely manner. This feature ensures that all issues are addressed promptly and effectively, improving customer satisfaction and trust.

In addition to tracking and monitoring complaints, the Complaint Management feature also provides tools for analyzing and reporting on complaints. This allows organizations to identify trends and patterns in complaints, which can be used to improve products and services, enhance customer service, and reduce the risk of future complaints.

Compliant Data Sharing

Compliant Data Sharing is indeed a significant feature in Salesforce’s Financial Services Cloud (FSC). It empowers admins and compliance managers to configure advanced data sharing rules, thereby enhancing compliance with regulations and company policies.

This feature allows control and monitoring of what data gets shared and with whom, without the need for complex code. It uses a setup object and several junction objects, including standard objects like Account Participant and Opportunity Participant, and custom objects like Participant and Participant Role.

Account Participant and Opportunity Participant are junction objects that store a relationship between a user or participant group, a participant role, and an account or opportunity record respectively. On the other hand, Participant represents information about a participant in the context of a custom object record, and Participant Role defines an available role for a parent object and an associated data access level.

Compliant Data Sharing is an additional feature that Salesforce offers for sharing data. It allows organizations to configure their org to get the most from the advanced data sharing capabilities. It uses participant roles to define how users and participant groups relate to a record. Each participant role specifies the access level it grants to a record when assigned to a participant.

Data Consumption Framework

The Data Consumption Framework is indeed a valuable feature in Salesforce’s Financial Services Cloud (FSC). It enables agents to access complete and current data from external systems without leaving Salesforce, thereby enhancing efficiency and productivity.

This framework extends the Continuations framework in FlexCards and OmniScripts, equipping them with integration definition capabilities for improved real-time performance. This means that the Data Consumption Framework not only facilitates data access but also optimizes the performance of data retrieval and processing.

The Data Consumption Framework supports two types of integrations: Service Integration and Process Integration. Service Integration uses the Continuation framework to communicate with the external system in real time while the agent waits and then delivers the response to Salesforce. On the other hand, Process Integration supports flows to perform tasks outside of Salesforce by a high volume of users. It makes an asynchronous callout to the external service, and the flow is paused while the call to the external service is pending. After the response from the external service is received, a platform event is raised to provide the paused flow with the response from the external service.

Discovery Framework

The Discovery Framework is a feature in Salesforce’s FSC that empowers users to create digital forms for data collection and validation. This innovative tool replaces time-consuming and error-prone manual methods, paving the way for a more streamlined and efficient data management process.

Leveraging the power of OmniStudio, the Discovery Framework allows users to manage every aspect of questionnaire-driven data collection, ensuring compliance with organizational policies. From creating reusable data maps to initiating complex data extraction and loading jobs, the Discovery Framework provides a comprehensive solution for data management in the financial services sector.

Document Generation

Document Generation is a feature in Salesforce’s FSC that allows users to generate a wide range of documents such as contracts, proposals, quotes, reports, non-disclosure agreements, service agreements, and more. This feature streamlines the document creation process, saving time and reducing the risk of errors.

Whether you need to create a detailed proposal for a potential client, generate a contract for a new partnership, or prepare a comprehensive report, Document Generation has you covered. It simplifies the document creation process, allowing you to focus on what truly matters – providing excellent financial services to your clients.

Document Checklist Items

Document Checklist Items is a feature in Salesforce’s FSC that allows you to manage your document approval process effectively. It enables you to define document types for commonly required documentation and create a document checklist item for each file required from a customer.

The key features of Document Checklist Items include the ability to define document types, create document checklist items, track the progress of documents through your approval process, and provide transparency for customers as they can track the progress of their uploaded documentation from submission to approval.

By using Document Checklist Items in Salesforce’s FSC, organizations can significantly increase their efficiency in managing and tracking documents, keep the document process organized and clear, and improve customer satisfaction by providing transparency in the document approval process. It’s a powerful tool that can help organizations streamline their document approval process, improve their operations, and enhance customer satisfaction.

Engagement

Engagement in Salesforce’s FSC refers to the interactions or engagements between a customer and a service agent. These engagements can take various forms, such as phone calls, emails, meetings, or any other form of communication.

The key component of this feature is the engagement data model. This model is used to store details about an engagement, providing a comprehensive view of the customer-agent interaction. The data stored can include the type of engagement, the time and date, the duration, the topics discussed, and any follow-up actions required.

By using the engagement data model, service agents can track and manage their interactions with customers more effectively. This can lead to improved customer service, better understanding of customer needs, and ultimately, a stronger customer relationship.

Events and Milestones

The Events and Milestones component provides a comprehensive view of your customers’ significant life events or milestones. This could include personal events like birthdays, anniversaries, or professional milestones such as promotions or retirement.

This feature allows businesses to identify upcoming opportunities and devise timely, personalized offers and engagement strategies. By having this information at your fingertips, you can better understand your customers’ needs and preferences, allowing you to provide a more tailored service.

In the context of a person account or contact record, the Events and Milestones component shows life events. For an account record, it displays business milestones. This ensures that you have the relevant information for each type of account, enabling you to provide a more personalized service.

Provide a Comprehensive View of Customer Financial Account Details

The FSCFinancialAccountsSummary component in Salesforce’s Financial Services Cloud is a comprehensive tool that allows service agents to view all the financial accounts, transactions, and record alerts associated with a customer’s accounts in one place. This includes details such as account balances, transaction history, investment details, loan details, insurance policies, financial goals, and the customer’s risk profile. The information displayed is stored directly in Salesforce, ensuring real-time accuracy and reliability. This comprehensive view of a customer’s financial account details enables service agents to resolve customer queries quickly and efficiently, enhancing the overall customer service experience. It’s a powerful tool for financial service providers aiming to deliver superior customer service.

Financial Deal Management

Financial Deal Management is a feature that allows businesses to track and manage the lifecycle of a financial deal. By using the Financial Deal Management data model, deal teams can manage every aspect of deal-related information. This includes creating new financial deal records that specify a deal’s stage, status, and the probability of deal success.

One of the key advantages of this feature is its compliant, role-based data sharing options. This means that deal records containing confidential information can be shared only with relevant stakeholders, ensuring compliance with data privacy regulations.

In essence, Financial Deal Management provides a comprehensive solution for managing financial deals. It not only helps in tracking the progress of a deal but also ensures that all the relevant information is available to the right people at the right time. This can significantly improve the efficiency of deal teams and increase the probability of deal success. It’s a powerful tool for any financial institution looking to streamline their deal management process.

Financial Plans and Goals

The Financial Goals feature allows clients to define and track their financial objectives. These could range from saving for a new car or a vacation, to long-term goals like retirement planning or buying a house. Each goal can be monitored individually, providing clients with a clear view of their progress and helping them make informed financial decisions.

On the other hand, the Financial Plans feature provides a comprehensive view of a client’s financial situation. It takes into account various factors such as income, expenses, assets, and liabilities to create a detailed financial plan. This plan serves as a roadmap to help clients navigate their financial journey and achieve their set goals.

These features leverage the power of OmniStudio, a suite of integrated, point-and-click tools that offer added customization. This ensures that each financial plan and goal is tailored to the unique needs and circumstances of the client

Groups (Householding)

The Groups (Householding) feature allows financial advisors to view and manage the financial information of a group of related clients, typically a household. It provides a holistic view of a household’s financial situation, including shared assets, liabilities, and financial goals. This enables financial advisors to offer more personalized and comprehensive financial advice based on the collective needs and goals of the household.

Moreover, this feature allows for the grouping of individual clients into a single household record, making it easier to manage and understand the financial complexities of families, trusts, and small businesses. It provides a 360-degree view of every household member’s relationships, interactions, and financial accounts.

Intelligent Document Automation for Consent and Disclosures

Intelligent Document Automation allows businesses to manage consent and disclosure documents efficiently. It enables the generation of authorization request forms tailored to the specific needs of each client. Furthermore, it provides the capability to track user responses, ensuring that all client interactions are recorded and easily accessible.

This feature not only simplifies the management of consent and disclosure documents but also enhances the client experience by making the process of giving consent more straightforward and transparent. By leveraging Intelligent Document Automation, financial service providers can ensure compliance, improve operational efficiency, and build stronger relationships with their clients. It’s a powerful tool for any financial institution looking to automate and optimize their consent and disclosure processes.

Intelligent Need-Based Referrals and Scoring

This feature allows businesses to source referrals both internally and externally across various lines of business. Users can create and automatically route referrals based on a customer’s expressed interest, ranging from savings accounts to home loans. This ensures that potential leads are directed to the most appropriate service based on their specific needs.

Additionally, the feature allows businesses to build processes that create automatic email notifications, keeping users up-to-date with the latest developments. The integrated dashboards and reports make it easy to identify and reward top referrers, fostering a culture of collaboration and recognition.

In essence, the Intelligent Need-Based Referrals and Scoring feature provides a smart, efficient, and rewarding way of managing referrals, driving business growth and enhancing customer satisfaction. It’s a powerful tool for any financial institution looking to optimize their referral management process.

Interaction Summaries

Interaction Summaries allow businesses to capture and share summaries of interactions with clients. This could include details of a phone call, a meeting, or any other form of communication. These summaries provide a concise record of what was discussed, agreed upon, or planned during an interaction.

This feature not only ensures that all important details are recorded and easily accessible but also enables businesses to share these summaries with relevant team members. This promotes transparency, improves collaboration, and ensures everyone is on the same page.

In essence, the Interaction Summaries feature in Salesforce’s Financial Services Cloud is a powerful tool that enhances communication and collaboration, ultimately leading to stronger client relationships and improved customer service. It’s an essential feature for any financial institution looking to improve their client communication and record-keeping processes.

Interest Tags

Interest Tags allow users to add custom tags to client records, capturing their needs, interests, and prospecting opportunities. This feature enables businesses to keep clients’ interests in mind during interactions, helping to deepen relationships and improve customer satisfaction.

Furthermore, Interest Tags can be organized into tag categories, grouping similar tags together. This organization makes it easy to create reports and dashboards that show common themes and interests across clients. This insight can be invaluable for identifying trends, tailoring services, and uncovering new opportunities.

Know Your Customers (KYC)

The KYC feature uses a data model that allows users to perform identity verification, risk assessment, and screening checks with ease. These checks can be performed on various parties, which could be accounts, contacts, or leads. This ensures that businesses have a comprehensive understanding of their customers, including their identity, financial behavior, and risk profile.

By leveraging the KYC feature, businesses can ensure compliance with regulatory requirements, reduce the risk of fraud, and build stronger, more personalized relationships with their customers. It’s an essential tool for any financial institution looking to enhance their customer understanding and maintain regulatory compliance.

OmniStudio for Financial Services Cloud

OmniStudio provides a range of features that allow for greater customization and efficiency. For instance, it enables admins to configure users, giving agents the ability to access remote sites. This can greatly enhance the flexibility and reach of your services.

Moreover, OmniStudio allows admins to customize appointment flows. This means that the process of scheduling and managing appointments can be tailored to fit the specific needs of your organization, improving efficiency and customer experience.

Record Alerts

Record Alerts are designed to alert agents to changes in client records that require action. This could include updates to a client’s financial status, changes in investment preferences, or any other significant modifications.

Agents can use Record Alerts to scan records for notifications. These notifications can show information from your core banking system or from alerts that are stored directly in Salesforce. This ensures that agents are always aware of the latest changes and can take appropriate action promptly.

Record Association Builder

The Record Association Builder allows businesses to define criteria for linking new or changed records with the branches that work with them. This could include linking a client’s account changes to their respective branch, or associating new financial products with the branches offering them.

This feature ensures that all relevant records are accurately linked and updated, providing a clear and organized view of the relationships between records and branches. This not only improves data management and accuracy but also enhances operational efficiency.

Rollup by lookup (RBL)

The Rollups feature supports client- and group-level record rollups, allowing businesses to aggregate and summarize data from multiple related records into a single record. This could include summing up the total assets of a client or calculating the average balance of accounts within a group.

Additionally, the feature supports Rollup by Lookup (RBL) rules. These rules enable businesses to define criteria for rolling up data based on specific lookup relationships between records.

Service Process Automation

The core component of Service Process Automation is the Service Process Studio. This is a framework that allows businesses to design case-driven service processes, starting from request intake all the way to fulfillment. This ensures a smooth and efficient service delivery process, enhancing customer satisfaction and operational efficiency.

Each service process includes an OmniScript for request intake through both assisted and self-service channels. This means that whether a customer prefers to interact with a service agent or use a self-service portal, their requests can be efficiently captured and processed.

Furthermore, Service Process Automation features flows for streamlined fulfillment. This ensures that once a request is captured, it is efficiently processed and fulfilled, further enhancing the customer experience.

Tear Sheet Generation

Tear Sheet Generation allows users to summarize information from one or more objects in a tear sheet using the Summary Document component. This could include key details from an account, contact, or financial deal record. The tear sheet provides a concise summary of the information, making it easier for users to review and understand the data.

Furthermore, for quick access, users can attach the generated tear sheet to an Account, Contact, or Financial Deal record page layout where the Summary Document component is added. This ensures that the summarized information is readily available whenever it’s needed.

Timeline in Financial Services Cloud

The Timeline feature provides a comprehensive and chronological view of all customer interactions. It shows key events relating to a person or a resource in one place. This could include interactions such as phone calls, meetings, emails, or any other form of communication with the customer.

By providing a complete history of interactions, the Timeline feature allows businesses to better understand their customers’ needs, preferences, and behavior. This understanding can lead to more personalized service, improved customer satisfaction, and ultimately, stronger customer relationships.

Transaction Dispute Management

In the financial services industry, managing transaction disputes efficiently and effectively is crucial for maintaining customer satisfaction and trust. Salesforce’s Financial Services Cloud offers a feature known as Transaction Dispute Management to facilitate this process.

Transaction Dispute Management provides a streamlined process for users to capture and submit customer disputes related to financial transactions. This feature allows for a quick and efficient resolution of disputes, enhancing the customer experience and maintaining the integrity of the financial institution.

The core of this feature is the Service Process Studio, which allows for quick configuration of the Transaction Dispute Management service process. This gives users a guided, step-by-step process for capturing customer disputes, ensuring that all necessary information is accurately recorded.

Furthermore, users can launch the dispute intake request directly from a customer’s record page in Salesforce. This ensures a seamless and integrated experience for both the user and the customer.