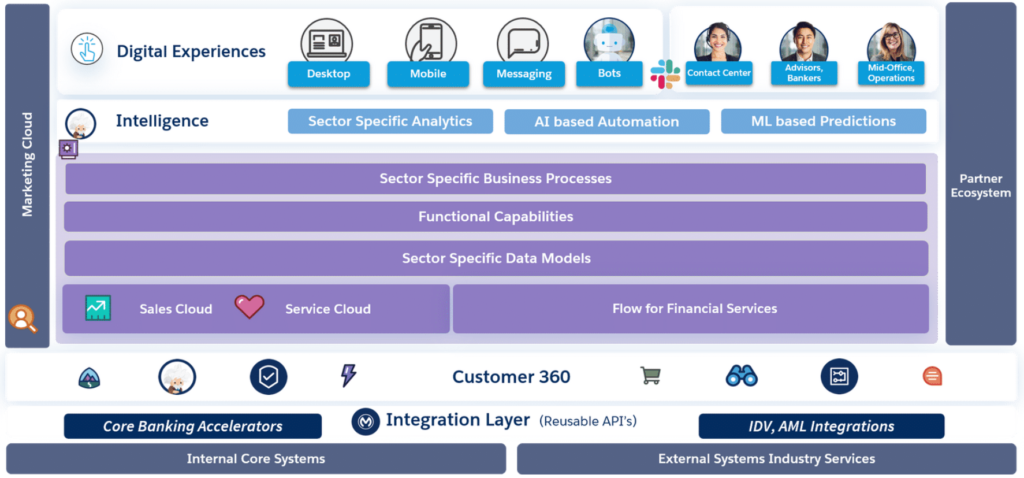

In today’s digital era, the financial services industry faces both vast opportunities and significant challenges. The Architecture of Salesforce Financial Services Cloud (FSC) is designed to meet these with a robust framework tailored for the nuances of financial operations. Integrating aspects like the Internal Core System and External System Industry Services ensures that institutions can deliver superior customer experiences while managing efficient workflows.

Internal Core System

The Internal Core System is essentially the backbone of the Salesforce Financial Services Cloud (FSC). It is built on the Salesforce platform and includes standard objects and custom fields that are fundamental to the functioning of the FSC. This system provides the basic structure upon which all other components are built, ensuring a robust and reliable foundation.

The core system offers the features of Sales Cloud along with custom fields and objects for tracking financial accounts, assets, liabilities, and client goals. This allows for a comprehensive data model that excels in managing client information, accounts, and records, providing a 360-degree view of individual and household financial data.

Moreover, the Internal Core System is fully integrated within the Salesforce world. It benefits from the power, scalability, and security of the Salesforce platform. This integration is not just an add-on, but a fundamental part of the system, making it a robust CRM system designed to meet the specific needs of the financial services industry.

External System Industry Services

The External System Industry Services are a critical component of the Salesforce Financial Services Cloud (FSC) architecture. These services are provided by external systems that cater specifically to the financial industry. They could range from banking to insurance, offering a wide array of functionalities.

These services allow Salesforce FSC to integrate and communicate with various external systems, enhancing its versatility and functionality. This integration is made possible through the use of APIs, which enable seamless communication between Salesforce FSC and these external systems.

For instance, Salesforce provides integration apps for integrating Financial Services Cloud with external banking systems. These integrations are inspired by the Banking Industry Architecture Network (BIAN) canonical model, which is a standardized framework for banking operations.

Moreover, these external services play a crucial role in enabling Salesforce FSC to provide comprehensive solutions for the financial industry. They allow Salesforce FSC to leverage the capabilities of external systems, thereby enhancing its own functionality. For example, an insurance company using Salesforce FSC could integrate with an external claims processing system, thereby enhancing its ability to process claims efficiently.

Core Banking Accelerators

The Core Banking Accelerators are a significant component of the Salesforce Financial Services Cloud (FSC) architecture. These accelerators are pre-built solutions designed to expedite the integration with core banking systems, ensuring a seamless and efficient connection between Salesforce FSC and the banking systems.

These accelerators are inspired by the Banking Industry Architecture Network (BIAN) canonical model, which is a standardized framework for banking operations. They provide a set of APIs and templates that enable you to accelerate time to value. You can use the assets as they are, or extend them to suit the needs of your own organization.

For instance, Salesforce provides integration apps for integrating Financial Services Cloud with external banking systems. These integrations reduce the time and effort required for integration, thereby enhancing the efficiency of the system.

Moreover, these Core Banking Accelerators play a crucial role in enabling Salesforce FSC to provide comprehensive solutions for the financial industry. They allow Salesforce FSC to leverage the capabilities of core banking systems, thereby enhancing its own functionality.

Integration Layer

he Integration Layer is indeed a vital component of the Salesforce Financial Services Cloud (FSC) architecture. It serves as the bridge that connects Salesforce with other systems, ensuring data synchronization and seamless communication.

This layer uses APIs to enable integration with both Salesforce and non-Salesforce systems. These APIs allow for the exchange of data and functionality between Salesforce FSC and other systems, enhancing the versatility and functionality of Salesforce FSC.

For instance, Salesforce provides integration apps for integrating Financial Services Cloud with external banking systems. These integrations are inspired by the Banking Industry Architecture Network (BIAN) canonical model, which is a standardized framework for banking operations.

Moreover, the Integration Layer plays a crucial role in enabling Salesforce FSC to provide comprehensive solutions for the financial industry. By ensuring seamless communication between Salesforce FSC and other systems, the Integration Layer allows Salesforce FSC to leverage the capabilities of these systems, thereby enhancing its own functionality.

IDV, AML Integration

The IDV (Identity Verification) and AML (Anti-Money Laundering) Integration is a key aspect of the Salesforce Financial Services Cloud (FSC) architecture. Compliance is indeed a critical aspect in the financial sector, and this integration ensures that these crucial compliance requirements are met.

Identity Verification (IDV) is a process that verifies the identity of customers. This is particularly important in the financial sector, where knowing the customer’s identity is crucial for various reasons, including preventing identity theft and fraud. Salesforce FSC comes with pre-integrated IDV solutions, allowing users to run document and biometric verification for new and existing customers.

Anti-Money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions. In most cases, money launderers hide their actions through a series of steps that make it look like money coming from illegal or unethical sources was earned legitimately. AML integration in Salesforce FSC helps in detecting any potential money laundering activities, ensuring compliance with regulatory requirements.

Together, IDV and AML integrations form a crucial part of the Salesforce FSC architecture. They allow Salesforce FSC to ensure that it is compliant with the necessary regulations, thereby enhancing its reliability and trustworthiness in the financial industry. These integrations also enhance the functionality of Salesforce FSC, allowing it to cater to a wide array of needs in the financial industry. They are a testament to Salesforce’s commitment to providing a fully integrated and compliant solution for the financial services industry.

Customer 360

The Customer 360 is a key feature of the Salesforce Financial Services Cloud (FSC) architecture. It is a Salesforce solution that provides a unified view of customers across all touchpoints, enabling organizations to have a comprehensive understanding of their customers and thereby enhancing customer relationships.

Customer 360 is designed to keep customers at the center of your business, allowing you to connect with them 1:1 at scale. It unites the entire organization — from marketing and sales to service, commerce, and IT teams. All Salesforce products and integrated third-party apps together form Customer 360, providing all teams with a single, shared view of all customers.

By helping track customers’ online activities, interactions with the company, and other customer data across touchpoints, Customer 360 gives each team the information they need to collaborate better and do their best work. And, in turn, provide connected, consistent customer experiences at scale.

On the solution, each customer is assigned a unique Global Profile ID (GPID), and all their data from across sources is connected back to it. This helps create a 360-degree customer view. So, when a customer makes a purchase using one credit card or downloads an article using a secondary email account, Customer 360 ties it all back to one GPID.

Salesforce solutions are powered by a built-in Artificial Intelligence (AI) engine — Einstein AI. It captures discrepancies common to data gathered from multiple sources (for example, different first names with the same email ID) and suggests best practices to fix those errors. Using the GPID, Customer 360 ships the corrected data back to the respective sources, ensuring data stays uniform across sources.

Sale + Service Cloud

Sales Cloud is Salesforce’s flagship product, designed to support sales, marketing and customer support in both business-to-business (B2B) and business-to-customer (B2C). It is a cloud-based Customer Relationship Management (CRM) platform that includes features like contact and opportunity management, collaboration tools, and analytics, enabling businesses to grow and manage their sales pipelines.

On the other hand, Service Cloud is a customer service and support application. It provides companies with a platform for managing all their customer service and support interactions, regardless of the channel through which the customer chooses to communicate. Service Cloud helps businesses to provide faster, smarter, and more personalized customer service.

Together, Sales Cloud and Service Cloud form an integral part of the Salesforce Financial Services Cloud (FSC), providing a consistent and seamless experience across financial services departments and channels. They enable organizations to have a 360-degree view of their customers, thereby enhancing customer relationships and driving growth.

Flow for financial Services

This tool leverages the capabilities of Salesforce Flow, a product that allows users to automate business processes by building applications, known as Flows. Using Flow, users can create guided visual processes, make their forms dynamic, integrate with external systems, and more.

In the context of Financial Services Cloud, Flow for Financial Services is used to automate complex business processes specific to the financial sector. This could include processes like loan origination, policy servicing, claims management, and more.

By automating these processes, Flow for Financial Services simplifies workflows and enhances efficiency. This allows financial institutions to focus on their core business activities, rather than getting bogged down by complex and time-consuming processes.

In essence, Flow for Financial Services forms an integral part of the Salesforce Financial Services Cloud architecture, enabling it to provide a robust and efficient platform for financial services. It is a testament to Salesforce’s commitment to providing fully integrated and automated solutions for the financial services industry.

Sector Specific Data Models

Sector Specific Data Models are data models designed specifically for different sectors within the financial industry. These models cater to the unique needs of sectors like banking, insurance, or wealth management. They provide a structured and flexible data model that is specific to the Financial Services Industry.

Salesforce FSC provides all standard Salesforce objects, plus out-of-the-box financial objects to represent your business data. Specialized objects include Financial Account, Financial Account Role, Financial Holding, Securities, and others. These objects form the basis of the sector-specific data models, providing a structured and flexible data model that is specific to the Financial Services Industry.

These data models allow for a comprehensive representation of business data, enabling organizations to have a 360-degree view of their customers and thereby enhancing customer relationships. They also provide the flexibility to extend the data model to support business requirements.

Functional Capabilities

The Functional Capabilities of Salesforce FSC are the specific features and functions tailored to the needs of the financial industry. They provide the tools necessary for organizations to operate effectively in their respective sectors, from sales and service to marketing capabilities. These include:

- Customer Service and Engagement: Enhanced customer service and engagement features are available in the Salesforce FSC and can be used to record and monitor vital customer data, such as financial goals, preferences, and life events.

- Lead Generation & Tracking: Salesforce FSC provides tools for generating and tracking leads, helping businesses to identify potential customers and track their interactions with the business.

- Analytics and Data Integration: Salesforce FSC integrates with a variety of data sources, providing businesses with deep actionable insights into clients and delivering valuable information throughout every stage of the client lifecycle.

- Security and Compliance: Salesforce FSC includes robust security features to protect customer data, and it also provides tools to help businesses comply with regulatory requirements.

- Workflow Automation: Salesforce FSC includes tools for automating complex business processes, helping to streamline workflows and enhance efficiency.

Sector Specific Business Processes

Sector Specific Business Processes are a crucial component of the Salesforce Financial Services Cloud (FSC) architecture. These processes are unique to specific sectors within the financial industry, such as banking, insurance, or wealth management

Salesforce FSC provides the flexibility to customize these processes according to the organization’s needs. This ensures that the solution is tailored to the specific requirements of each sector.

For instance, Salesforce FSC comes with pre-assembled flows for the Financial Services Industry. Customers can make appropriate changes to these flows to tailor them to their specific needs and quickly go live instead of spending months developing custom processes. Some of the available out-of-the-box flows include “Activate Card”, “Close Account”, “Issue New Card”, “Update Address”, and “Order Checks”.

Intelligence Layer

The Intelligence Layer is powered by Salesforce’s proprietary AI technology, Einstein. Einstein uses machine learning, deep learning, predictive analytics, and natural language processing to analyze data and generate insights. These insights can help organizations make data-driven decisions, enhancing their ability to respond to market trends and customer needs.

For instance, Einstein can analyze customer data to predict future behavior, identify sales opportunities, recommend next best actions, and even automate routine tasks. This can greatly enhance the efficiency and effectiveness of sales, service, and marketing processes.

Moreover, the Intelligence Layer is fully integrated with the rest of the Salesforce FSC, meaning it can leverage all the data in the system, including customer data, transaction data, and more. This allows for more accurate and meaningful insights.

Digital Experience Layer

The Digital Experience Layer of Salesforce FSC includes two primary UI components built on Salesforce Lightning web components (LWC) that run inside Salesforce and improve the UI performance. It offers rich user interaction experiences for users.

This layer is designed to provide a seamless and intuitive user experience, enhancing user satisfaction and productivity. It ensures that users can easily navigate the system and access the information they need.

Moreover, the Digital Experience Layer is fully integrated with the rest of the Salesforce FSC, meaning it can leverage all the data in the system, including customer data, transaction data, and more. This allows for a more personalized and engaging user experience.